Medicare Advantage Plans are a type of health insurance plan that is an alternative to Original Medicare (Part A and Part B). Private insurance companies generally offer these Medicare Advantage insurance plans. Medicare. In general, the Medicare Advantage plan needs you to pay a monthly premium in addition to the Component B costs you pay for Original Medicare.

Choosing the right Medicare Advantage plan is important because it can affect the quality of your healthcare and your out-of-pocket costs. Here are a few reasons why it’s important to choose the right plan:

Coverage: Different Medicare Advantage plans offer different levels of coverage. Some plans may cover more services than Original Medicare, while others may have more limited coverage. It’s important to choose a plan that covers the services you need.

Cost: Medicare Advantage plans often have different premiums, copayments, and coinsurance amounts. Choosing a plan with lower out-of-pocket costs can help you save money on your healthcare expenses.

Network: Most Medicare Advantage plans have a network of healthcare providers that you can see for covered services. It’s important to choose a plan with a network that includes the doctors, hospitals, and other providers you prefer.

Customer service: It’s important to choose a Medicare Advantage plan that has good customer service. This can make it easier to get the information and assistance you need.

Extra Benefits: Some Medicare Advantage plans offer extra benefits, such as coverage for vision, hearing, or dental care. If these types of services are important to you, look for a plan that offers them.

There are several factors to consider when choosing a Medicare Advantage plan, including cost. Here are some tips for considering the cost of a Medicare Advantage plan:

Consider your monthly premiums: You’ll need to pay a monthly premium for most Medicare Advantage plans. Make sure the premium fits into your budget.

Consider your out-of-pocket costs: While Medicare Advantage plans often have lower out-of-pocket costs than Original Medicare, you’ll still need to pay deductibles, copayments, and coinsurance for certain services.

Compare the cost of different plans: It’s important to compare the costs of different Medicare Advantage plans in your area. You can use the Medicare Plan Finder tool to compare the costs and coverage of different plans.

Consider your prescription drug costs: If you take prescription drugs, make sure the plan covers the medications you need at a cost you can afford.

Consider any additional benefits: Some Medicare Advantage plans offer additional benefits, such as vision, dental, or hearing coverage. These benefits can be valuable, but they may also come at an additional cost. Make sure you weigh the value of these benefits against the cost.

Here are a few specific reasons why it’s important to make sure your Medicare plan covers the medical services you need:

Avoid surprise costs: If you have a medical condition or take medication for a chronic condition, you’ll likely need certain services or treatments on a regular basis. If your plan doesn’t cover these services, you may have to pay for them out of pocket, which can be a financial burden.

Get the care you need: It’s important to have access to the medical care you need to manage your health. If your plan doesn’t cover a particular service or treatment, you may be less likely to get the care you need, which could negatively impact your health.

Save money: As I mentioned earlier, having a Medicare plan that covers the services you need can help you save money on healthcare costs. You’ll pay less for covered services, which can add up over time.

It is important to look at the provider network of a Medicare Advantage plan because it will determine which healthcare providers you can see and which services will be covered by the plan. A provider network is a group of healthcare providers that have agreed to provide services to members of a particular insurance plan at a discounted rate.

Here are a few reasons why it is important to look at the provider network when selecting a Medicare Advantage plan:

Access to care: The provider network will determine which doctors, hospitals, and other healthcare providers you can see for covered services. It’s important to make sure the plan includes providers you are comfortable seeing and that are conveniently located for you.

Coverage for services: In order for a service to be covered by your Medicare Advantage plan, it must be provided by a provider in the plan’s network. If you see a provider that is not in the plan’s network, you may have to pay for the service out of pocket.

Quality of care: The provider network may include high-quality healthcare providers that are known for delivering good care. It’s worth considering whether the provider network of a particular Medicare Advantage plan includes providers with a good reputation.

When selecting a Medicare Advantage plan, it is important to consider the quality of the plan. Here are some tips to help you choose a high-quality Medicare Advantage plan:

Check the plan’s ratings: Medicare Advantage plans are rated on a scale of 1 to 5 stars, with 5 being the highest rating. You can find a plan’s rating on the Medicare Plan Finder tool on the Medicare website.

Look for a plan that includes the benefits you need: Make sure the plan you choose covers the benefits you need, such as prescription drugs, routine dental care, or wellness programs.

Consider the plan’s network of providers: Make sure the plan you choose includes the doctors, hospitals, and other providers you prefer.

Look for a plan with low out-of-pocket costs: Consider the plan’s deductibles, copayments, and coinsurance to determine how much you’ll have to pay out of pocket for covered services.

Check the plan’s customer satisfaction ratings: Look for a plan that has high customer satisfaction ratings, as this can be an indication of the quality of the plan.

It’s also a good idea to review the plan’s annual notice of the change (ANOC) and evidence of coverage (EOC) documents, which outline the plan’s benefits, premiums, and other important information.

Here are a few reasons why it is important to choose a high-quality Medicare Advantage plan:

Access to care: A high-quality Medicare Advantage plan should have a network of providers that includes a wide range of doctors, hospitals, and other healthcare professionals. This will give you more options for receiving care.

Coverage: A high-quality Medicare Advantage plan should provide comprehensive coverage for the services you need. It is important to carefully review the plan’s benefits and coverage to make sure it meets your needs.

Customer service: A high-quality Medicare Advantage plan should have responsive customer service and be able to answer your questions and address any concerns you may have.

Cost: It is important to consider the out-of-pocket costs associated with a Medicare Advantage plan, including premiums, copays, and deductibles. Choose a plan that fits your budget and meets your healthcare needs.

By choosing a high-quality Medicare Advantage plan, you can ensure that you have access to the care you need at a price you can afford.

When selecting Medicare Advantage Insurance package the important factor is the “extras” that the plan offers, such as dental, vision, and hearing coverage. Here are some things to think about when considering the extras offered by a Medicare Advantage plan:

Ultimately, the decision to choose a Medicare Advantage plan with extras will depend on your individual needs and budget. It’s a good idea to carefully consider your needs and do some research to find the plan that is the best fit for you.

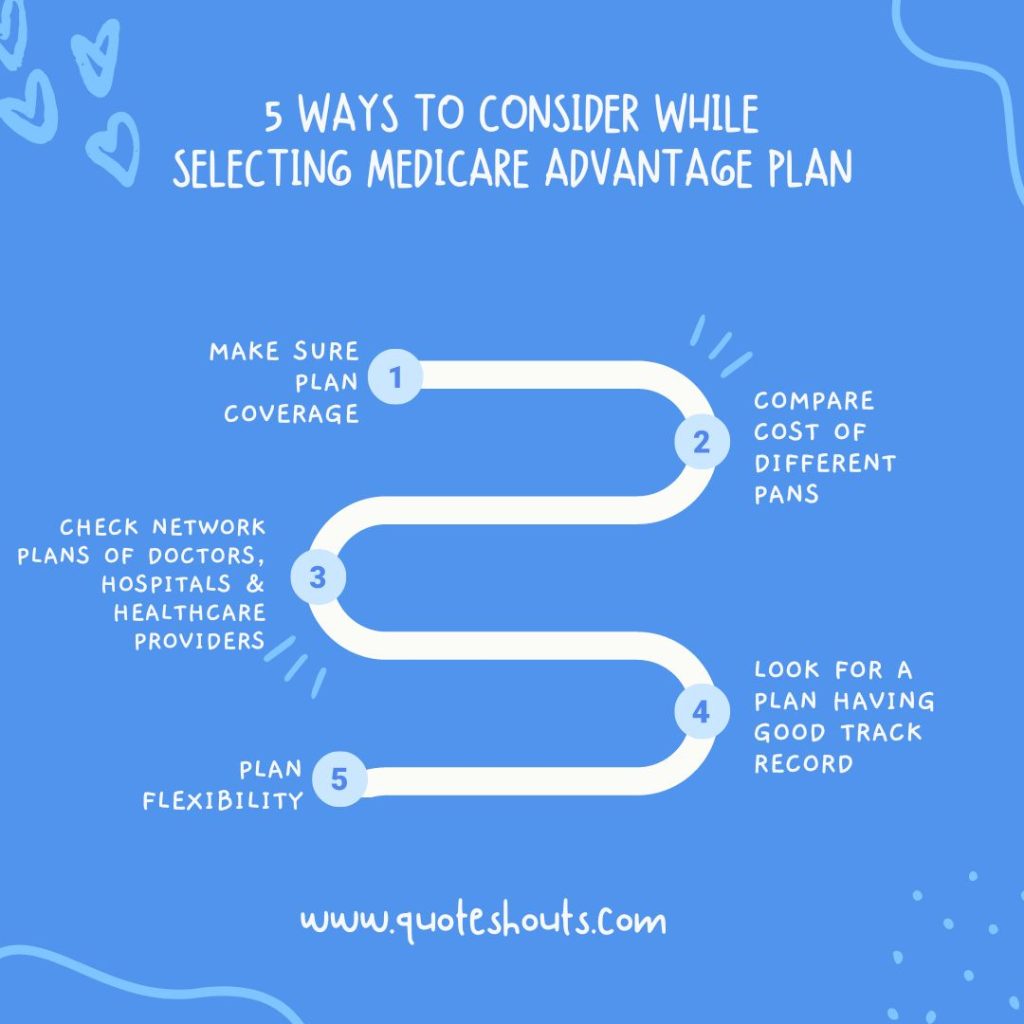

There are a few key things to consider when selecting a Medicare Advantage package to ensure that it meets your current and future health needs:

Coverage: Make sure the plan covers the medical services and treatments you currently need, as well as any you may need in the future. This includes prescription drug coverage, hospital stays, and outpatient services.

Cost: Compare the costs of different plans, including premiums, deductibles, copays, and out-of-pocket maximums. Look for a plan that fits your budget and offers good value for the coverage it provides.

Network of providers: Check the plan’s network of doctors, hospitals, and other healthcare providers to ensure that you’ll have access to the care you need.

Quality of care: Look for a plan that has a good track record of providing high-quality care to its members. This may include measures of patient satisfaction, outcomes, and preventive care.

Flexibility: Consider whether the plan offers options such as telehealth services, fitness benefits, or transportation to appointments, which can be convenient and helpful for managing your health.

It may also be helpful to consult with a healthcare professional or someone familiar with Medicare Advantage plans, such as a Medicare counselor or insurance agent, to get personalized advice on which plan may be best for you.

There are several steps you can follow when choosing a Medicare Advantage plan:

Determine if you are eligible for a Medicare Advantage plan. To be eligible, you must be enrolled in both Medicare Part A (hospital insurance) and Part B (medical insurance).

Consider your needs and budget. Think about your current health and any medical needs you may have in the future, as well as your budget for out-of-pocket expenses.

Compare plans. There are many Medicare Advantage plans available, so it’s important to compare them to find the one that best meets your needs. You can use the Medicare Plan Finder tool on the Medicare website to compare plans in your area.

Check for provider network. Make sure the plan you choose includes your preferred doctors, hospitals, and other healthcare providers in its network.

Consider additional benefits. Some Medicare Advantage plans offer additional benefits, such as coverage for prescription drugs, vision, and dental care. Decide which additional benefits are important to you and look for a plan that offers them.

Enroll in a plan. Once you have chosen a plan, you can enroll through the Medicare website or by contacting the plan directly.

It’s important to keep in mind that you can change your Medicare Advantage plan during certain times of the year, so if you find that your plan is not meeting your needs, you have the option to switch to a different one.

If you are enrolled in Medicare and considering enrolling in a Medicare Advantage plan, you will need to pay a premium in addition to your Part B premium. The premium for a Medicare Advantage plan can vary depending on the plan you choose and the area you live in. Here are some things to consider when selecting a Medicare Advantage plan with a premium:

Check out the detailed guide for Medicare insurance premium changes in 2023.

Cost: Compare premiums for different plans in your area to find the one that fits your budget. Keep in mind that some plans may have lower premiums but higher out-of-pocket costs for services.

Benefits: Look for a plan that offers the benefits you need, such as coverage for prescription drugs, dental and vision care, and fitness programs.

Network: Make sure the plan you choose has a network of providers that includes the doctors, hospitals, and other healthcare providers you use.

Ratings: Check the ratings for the plans you are considering. Higher-rated plans generally provide better quality care.

Customer service: Consider the customer service ratings for the plans you are considering. You may want to choose a plan with a high rating for customer satisfaction.

It’s important to compare plans and choose one that meets your needs and fits your budget. You can use the Medicare Plan Finder tool on the Medicare website to compare different Medicare Advantage plans in your area.

QuoteShouts was founded with a defiant spirit to focus on a single purpose “Making Quotations Easy & Simple”.

Copyrights © 2022 Quote Shouts